European Labor Market Trends in 2023: Vacancies, Recruitment and Job Advertisements

A new study and the latest statistics from the EU commission are out and we have now an overview about the EU labor market and the impact of war and other calamities during 2023. In general the good news is that there is still a very low unemployment rate but many countries had some significant macro-economical changes.

What are the most requested jobs in Europe?

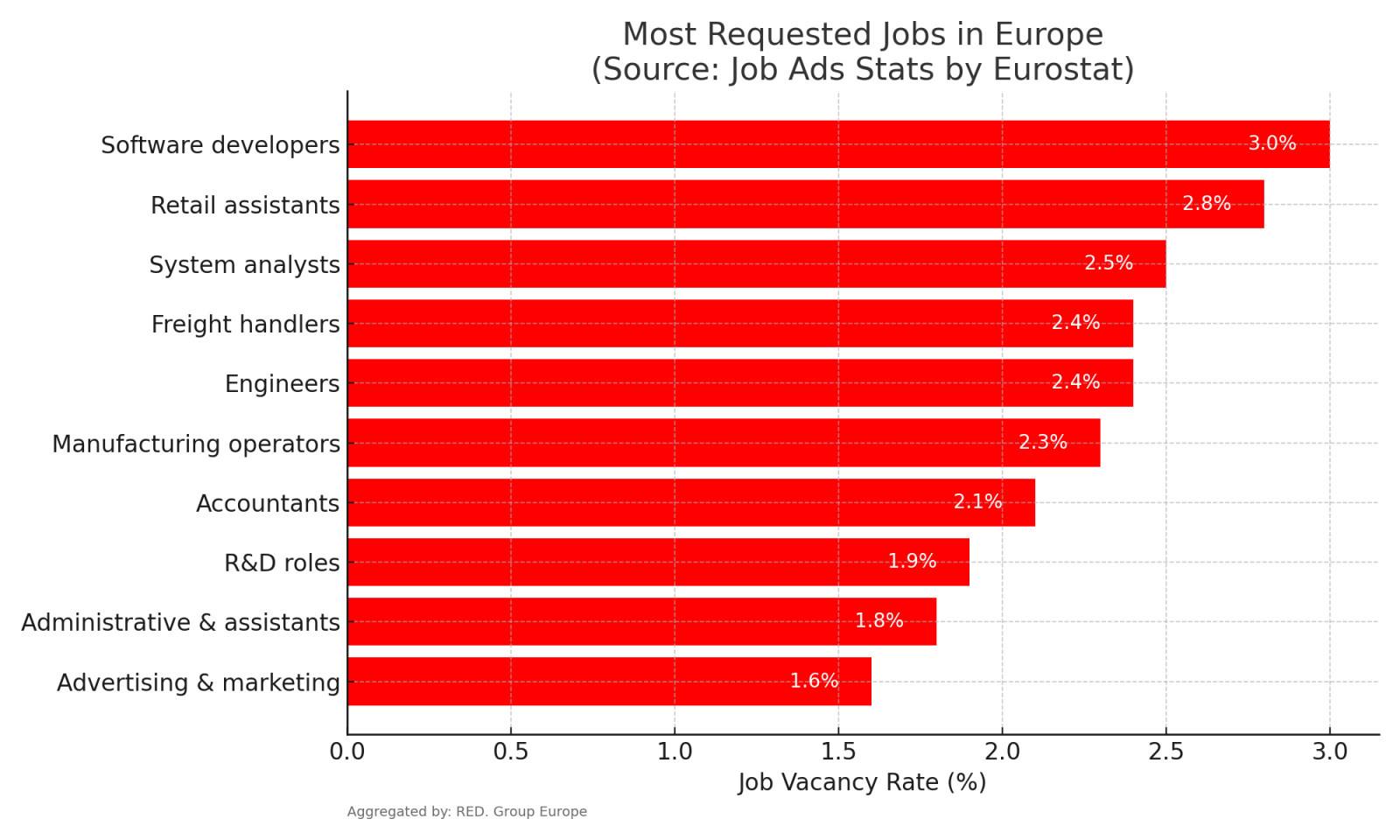

Analyzing the most recent data from Eurostat and studies from the EU Commission, it's clear that the European labor market is teeming with opportunities, each with varying degrees of demand. Software developers are leading the pack, with a 3% job vacancy rate, a clear indicator of the tech-driven momentum that European industries are experiencing. Retail assistants are next in line with a 2.8% vacancy rate, a testament to the ever-relevant and bustling consumer market in Europe. Additionally, roles such as system analysts, freight handlers, engineers, and administrative assistants are all experiencing significant demand, each contributing to the diverse and multifaceted European employment landscape. The chart, aggregated by RED. Group Europe, provides a succinct visual representation of these trends, serving as a valuable guide for job seekers and employers alike to navigate the plethora of opportunities available in the region.

The European labor market is characterized by a dynamic interplay of demand and supply, shaped by economic, technological, and demographic changes. A careful analysis of job vacancies, recruitment activities, and sector-specific demands offers a nuanced understanding of the current trends and challenges in the labor market. In this post, we delve deep into the labor market in Europe, focusing on main job categories.

Overview of Job Vacancy Rates in Europe

Job vacancy rates serve as a critical barometer of labor market health, reflecting the unmet demand for labor across various sectors and regions. A higher job vacancy rate typically indicates a higher demand for labor, pointing to potential skill shortages in the market.

1.1 Country-wise Analysis:

The recent data from the second quarter of 2023 reveals varying job vacancy rates across different European countries. Germany leads with a substantial overall job rate of 1,729,112, followed by the Netherlands (437,800), Belgium (194,957), Austria (193,140), and Sweden (170,546). These figures signify a high demand for various professional roles in these countries, with employers actively seeking qualified candidates to fill the vacant positions.

1.2 Sector-wise Analysis:

A sectoral breakdown of job vacancy rates in the European Union (EU) shows that the "Administrative and Support Service Activities" sector (NACE code: N) has the highest job vacancy rate at 4.3%. This is closely followed by the "Accommodation and Food Service Activities" sector (NACE code: I) and the "Professional, Scientific, and Technical Activities" sector (NACE code: M), both having a vacancy rate of 3.7%.

Section 2: Diving into Sectoral Demands

2.1 IT Professionals and Software Developers:

The significant job vacancy rate in the "Professional, Scientific, and Technical Activities" sector highlights a pronounced demand for IT professionals, software developers, and system analysts. Recruitment agencies are intensifying their efforts to identify candidates with specialized skills in software development, data analysis, and IT management to meet the burgeoning demand in this sector.

2.2 Administrative Assistants:

The high vacancy rate in the "Administrative and Support Service Activities" sector underscores the ongoing search for administrative assistants. The surge in job advertisements for administrative roles is a testament to the crucial role these professionals play in ensuring organizational efficiency.

2.3 Shop Assistants and Freight Handlers:

The considerable demand in the "Accommodation and Food Service Activities" sector indicates a pressing need for shop assistants and freight handlers. These roles are integral in maintaining operational flow in retail and food service establishments, emphasizing the importance of these professions in the overall economic landscape.

Regional Insights and Opportunities:

3.1 Belgium:

Belgium emerges as a significant hub of opportunities, exhibiting one of the highest job vacancy rates in Europe. The diverse and open economy of Belgium is attracting a multitude of candidates, making it a focal point for recruitment agencies.

3.2 Germany:

Germany, with its robust economy and high overall job rate, is experiencing a highly competitive market. The active recruitment landscape in Germany is characterized by a plethora of job advertisements, signaling a myriad of opportunities for prospective candidates.

Implications and Forward Path:

The evolving landscape of the European labor market necessitates a strategic approach from candidates, employers, and recruitment agencies. The insights derived from the analysis of job vacancy rates and recruitment activities are instrumental in identifying skill gaps, aligning educational and training programs with market needs, and formulating policies to address labor market imbalances.

How is the situation then in the EU Labor Market in Q2-Q3 2023?

The intricate tapestry of the European labor market is woven with diverse threads of opportunities and challenges. The detailed examination of job vacancies, sectoral demands, and regional trends provides a roadmap for navigating the complexities of the labor market. As Europe strides forward, the alignment of skills, education, and training with the emerging needs of the labor market will be pivotal in fostering economic growth and resilience.

Wether you are looking for new employees or new job opportunities, given the data mentioned above, you might want to get in touch with a specialised white collar recruitment agency like RED. Recruitment at our contact form or our evergreen Open vacancies page.